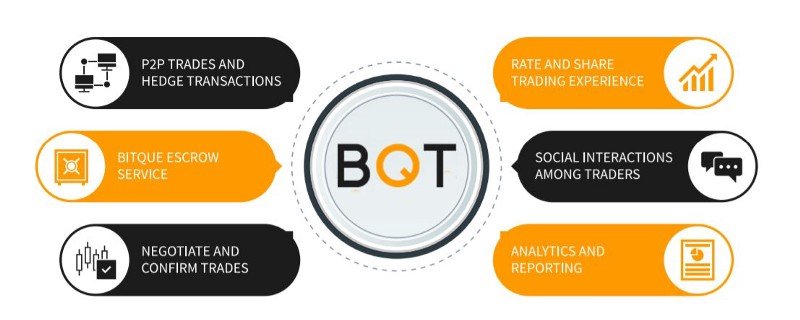

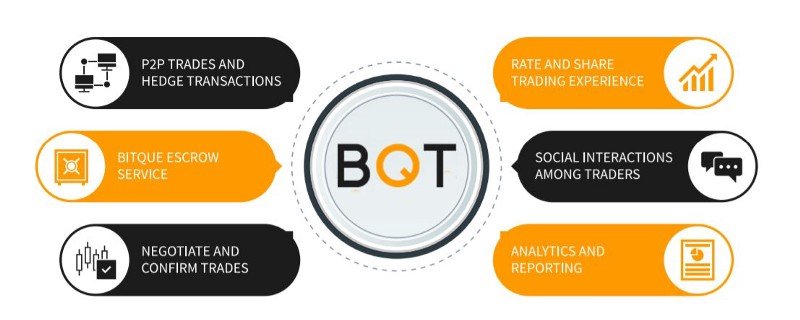

BQT Exchange Platform provides secure, interactive and flexible P2P Trading Environment and user-friendly interface for its community to manage various types of transactions consisting of many crypto assets. BQT platform allows traders globally to negotiate their Crypto Asset trades directly interacting with each other and sharing their experience with the community.

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency.The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees

While many Blockchain experts are trying to find more ways to marry CRYPTO with FIAT,BQT Team believes in reducing dependency on FIAT altogether. Every Crypto Asset has its value and can be used as negotiating tool to acquire another Crypto Asset. We believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of

various Crypto asset holdings and negotiated directly by trader peers.

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

To leverage holdings of various Crypto Assets, BQT introducing the revolutionary Hedge Trades system. Unlike Margins and Futures Trading, BQT Hedge Trade system is a flexible method for Traders of acquiring Crypto Assets for a short-term period by means of escrow of their existing Crypto holdings.

To leverage holdings of various Crypto Assets, BQT introducing the revolutionary Hedge Trades system. Unlike Margins and Futures Trading, BQT Hedge Trade system is a flexible method for Traders of acquiring Crypto Assets for a short-term period by means of escrow of their existing Crypto holdings.

This revolutionary approach allows Crypto Traders leverage their Crypto Holdings to acquire significant number of additional Crypto Assets they believe in without a need of a traditional margin trade

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency.The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees

While many Blockchain experts are trying to find more ways to marry CRYPTO with FIAT,BQT Team believes in reducing dependency on FIAT altogether. Every Crypto Asset has its value and can be used as negotiating tool to acquire another Crypto Asset. We believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of

various Crypto asset holdings and negotiated directly by trader peers.

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

This revolutionary approach allows Crypto Traders leverage their Crypto Holdings to acquire significant number of additional Crypto Assets they believe in without a need of a traditional margin trade

The BQTX Token

Running an ICO is useless when your tokens/coins don't have any utility on your product. Rest assured, this won't happen in BQT. BQTX is an ERC20 utility token on the BQT platform. In order to use BQT, you must have BQTX, because trading fees are only payable via BQTX tokens. This will create a high demand for BQTX tokens, especially if the platform is massively adopted. By 'forcing' every' user to get BQTX tokens, the values of BQTX will increase along with its adoption.The BQTX token can also be used as the main collateral or additional collateral for hedge trading. By doing so, users can choose to use BQTX rather than using their other cryptocurrencies. Because 50% fees from the BQT platform is shared quarterly to top traders and referral affiliate partners, I can say for sure that the demand for BQTX will also high, because everybody who wants to get the share must have a high trading activity and refers other users to this platform, which in turn increase the demand for BQTX tokens.

There will be a lock-up period. Up to 600 million tokens will be frozen by BQT and it will be released up to 10% per year if demanded necessary for expansion, marketing, and loyalty programs. The team and management will reserve up to 20% of the tokens and it will be locked up for 3 years. This will create a scarcity at first so it will help to stabilize, and possibly increase the price gradually. Rest assured, the team looks very committed to this project.

Large Exchanges

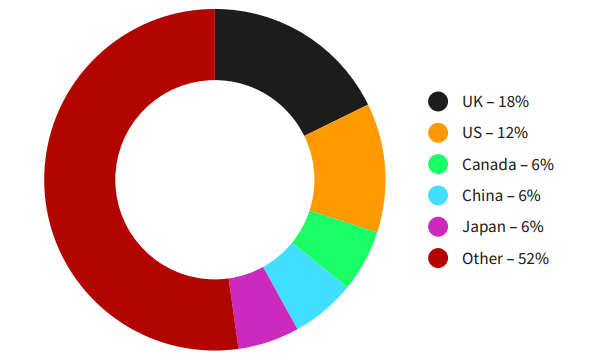

Cambridge study shows that only 22% of large exchanges and 4% of small exchanges offer a platform that includes an order-book exchange, trading platform and brokerage services. While 15% of small exchanges provide a standalone trading, platform comparing to large exchanges which generally combine this activity with an order-book exchange.

P2P exchanges have yet to gain more popularity but still only 2 of the 51 of the P2P exchanges provide a decentralized marketplace for exchanging cryptocurrencies. All exchanges support bitcoin, while Ethereum and Litecoin for comparison are listed on only 40% of exchanges. Only a minority of exchanges make markets for the exchange of cryptocurrencies other than the above three. While 39% of exchanges solely support bitcoin, 25% have two listed cryptocurrencies, and 36% of all entities enable trading three or more cryptocurrencies.

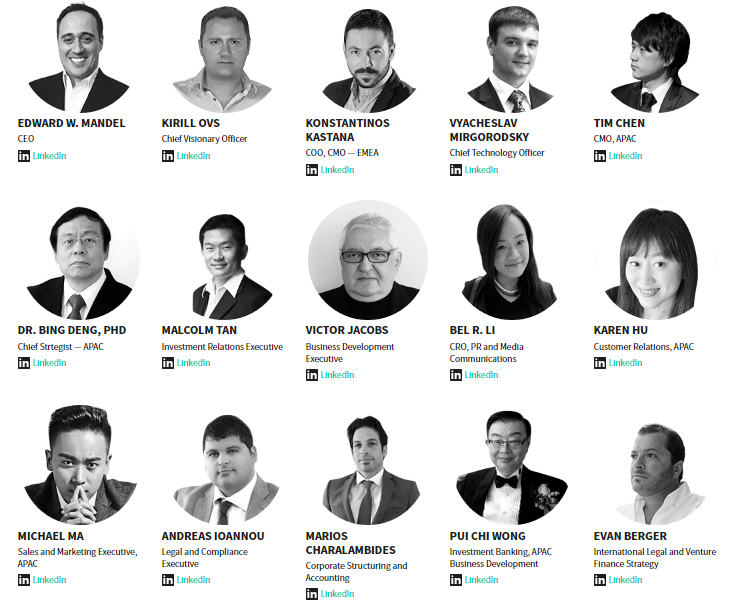

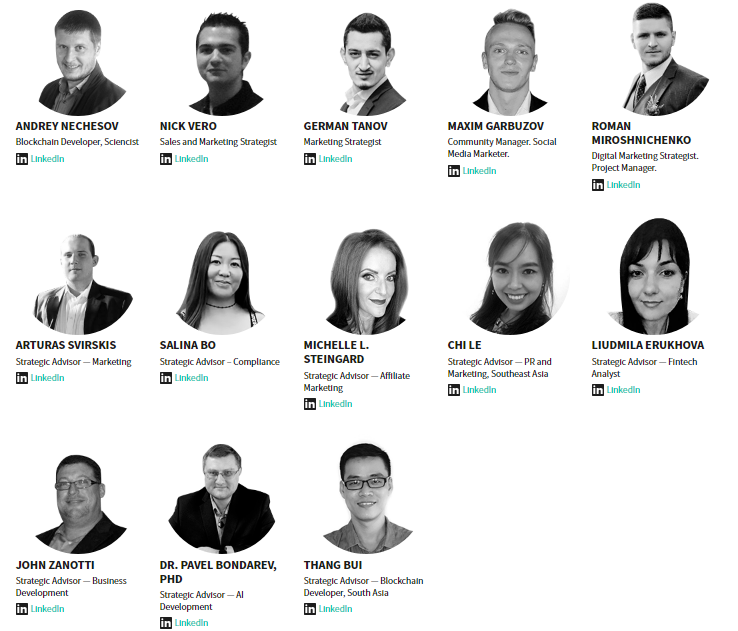

TEAM AND STRATEGIC ADVISORS

FURTHER INFORMATION

Author : janinnaweigel

Profil bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2347561

Eth : 0x31BD58f2F65c62Ce8248A5df0d448505d461cE85

No comments:

Post a Comment